In difficult times, your savings are useful to you, everyone has some kind of financial problem, whether it is health, emergency accident or any other related problem, so if you do not have any savings then you have only one option.

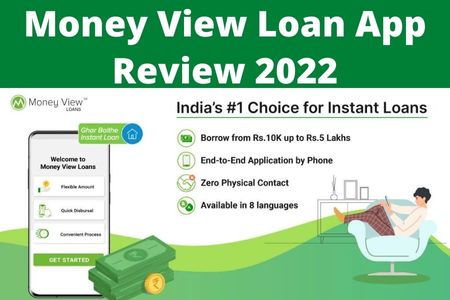

There is an option left to borrow from someone and for this, you go to the bank, but today we have brought a solution to your problem and have brought such a loan platform for you from where you can apply online for an instant personal loan up to 5 lakhs And for this, you will not even need to go to the bank You will only need a smartphone to take the loan and you can apply for the loan sitting at home online. We are talking about the Money View.

Which offers you a personal loan with a very affordable interest rate, so let’s know only about Moneyview Instant Loan in today’s article post, I hope you will definitely read this article till the end.

What is Money View App?

Money View is an instant personal loan and credit line platform from where you can apply for an instant online loan.

In the beginning, you can take a loan of 10,000 to 5,00,000 from here in a few minutes. It is trusted by more than 1 crore people.

On this app, those people can apply for a loan, who is in any job, government or private or any business of their own.

The loan repayment tenure ranges from 3 months to 5 years. With easy EMI, this app provides a user friendly interface to its users so that one can easily understand and apply for the loan.

| Loan Amount | From Rs.10,000 to Rs.5,00,000. |

| Tenure/ Repayment Period | From 3 months to 5 years. |

| Interest Rate | 16% to 39% per annum. |

| Processing Fees | 2% to 8% of your loan amount. |

| Check bounce | Penalty fee of Rs.500 on every check bounce |

Features and Benefits of Money View Instant Personal Loan

- With Moneyview, you can get an instant personal loan range from Rs 10,000 to Rs 5 lakh.

- Money View offers both salaried and self-employed loans against their fixed income.

- Own Credit Model: You can get better offers irrespective of your credit score.

- Easy EMI: You can repay the loan amount in 3 months to 60 months as per your convenience.

- Hassle free: 100% paperless application process

- 100% Transparent: No hidden charges, no surprises.

- Service is available in more than 5000 locations across India.

- Available in eight languages.

- Loan available with minimum civil score/credit score.

- You can track your entire loan repayment on the Money View app.

- You can choose from a wide range of Flexible EMIs.

- 24×7 customer support is available.

- 100% complete loan process is digital.

- You can apply online for the loan sitting at home just from your smartphone.

- After verification, the loan amount is directly transferred to your bank account within 24 hours.

- For Instant Loan from MoneyView you can apply for a loan online anytime from anywhere.

Money View Personal Loan Interest Rates & Charges

Money View gives you a loan amount ranging from Rs.10,000 to Rs.5 lakh with an annual interest rate of 16% to 39% on a repayment tenure of 3 months to 5 years apart from processing fees you have to pay 2% to 8% which Deducted from your principal amount.

Money View Personal Loan Eligibility Criteria

To take a Money View loan, you must have some Eligibility, only after which you can apply for an online loan from Money View. Many factors work for taking a loan from Money View.

To take a loan from Money View, you must have the following qualifications given below.

- The applicant must be a resident of India to take the loan.

- The age of the borrower should be between 21 years to 57 years.

- You must have a savings bank account to apply for the loan.

- You must have a fixed source of monthly income to take a loan.

- You must be a salaried employee, self employed or a businessman to avail the loan.

- You must have a minimum CIBIL score of 650 and Experian score 750 to avail instant personal loan from Moneyview.

Money View Instant Personal Loan Documents Required

While applying online for taking a personal loan from Moneyview, you need to submit some important documents after which you can apply for the loan online.

- Identity Proof ( Aadhar Card, Pan Card, Driving licence, passport, voter ID card etc.)

- Address Proof

- Salary Slip For Salaried individual

- Income Proof

- 6 month Bank statement

- Passport size photo

Top 10 Reasons to Apply for An Instant Personal Loan from Money View

Let me tell you about the top 10 reasons why you should take a personal loan from Money View;

User-friendly Personal Loan App:-

Money View personal loan app provides a user-friendly and easy interface to its users which makes applying for loan even easier as well as here you get various options of personal loan with different amount and repayment period.

Flexible Repayment Term:-

Moneyview offers a flexible tenure of maximum 5 years for personal loans. The borrower can choose the repayment tenure as per his convenience as per the loan offer.

Multipurpose Loan:-

The borrower can use the personal loan taken from Money View for any purpose. The special thing is that you are free to use the loan amount anywhere.

Build a Credit History:-

You can build up your good credit score by timely repaying the personal loan taken from Money View.

Unsecured Loan:-

Personal loans taken from Moneyview are collateral free. The borrower is not at any risk of losing any asset on any default loan amount.

Offer Quality Services:-

With Money View, the applicant can apply for a personal loan online anytime, anywhere and take a personal loan with a convenient and low interest rate.

Quick Loan Disbursal :-

After approval of the personal loan application from Moneyview, the loan amount is directly transferred to your bank account within 24 hours. Money View is one of the best tools to solve your financial problem. which provides you with a loan in very less time.

High Approval Rate:-

The chances of loan approval are high on online applications from Money View. This is a very large sector and so far it has provided loans to more than 10 million people.

Pan India Coverage:-

Money View is serving in more than 5,000 locations across India. And it is continuously taking its service from Tier I cities to Tier II cities.

Online Loan Process:-

The entire process for taking online loans from Moneyview is 100% digital and online. It allows the borrower to apply for a loan online without any paperwork and with minimal documentation. You can apply for a loan online sitting at home just from your smartphone. You can take out a loan at any time from any place. You do not even need to go to the bank for the loan.

How to Track Your Instant Personal Loan Application

Once you have applied for a loan with Money View, you can check your online loan status anytime, anywhere with Money View online application. There are many ways for you to check your loan status, depending on the platform from which you have applied for the loan.

1. If you’ve applied via the Money View website

If you have applied for loan through Money View website and want to check your loan status then you can follow the steps given below ;

Step-1. First of all open the website of Money View and go to the login section.

Step-2. Now tap on the option of Apply Loan or Sign Up.

Step-3. Now login to your account on Money View website through your registered email id.

Step-4. After this you go to the dashboard section of your Money View account.

Step-5. Now scroll down you will see the option of Application Status, tap on it, now here you can check your application status.

2. If you’ve applied through the Money View App

If you want to track the status of your loan application through Money View application then you can follow the steps given below ;

Step-1. First of all install the Moneyview app from google play store then opens it.

Step-2. Now register yourself on this application with your valid email id or mobile number, if you are already registered then forget it.

Step-3. Now on the homepage of Moneyview Application you will see the section of loan at the top, click on it.

Step-4. Once you go to this option you will be automatically redirected to Application States.

Step-5. Now here you can easily check your online loan application status.

Money View Personal Loan Customer Care

If you have any query related to taking a loan on Moneyview or any other type of problem, then you can easily talk to their customer executive from the below contact details and get the solution to your problem. This app provides you customer support 24 hours a day 7 days a week.

Contact No. : 08 04569 2002

E-mail Address: [email protected]

For loan repayment queries: [email protected]

For loan-related queries: [email protected]

For FAQs: [email protected]

Conclusion

So friends, in today’s article, we have learned about one of the best loan platforms Money View in India and also how you can take a personal loan up to Rs 5,00,000 from Moneyview, so if you are also facing any kind of financial problem.

If yes, then definitely try this loan platform once, possibly you will get the loan amount according to your ability, so friends, in today’s article post, just follow us for a similar loan, app review, and information related to money-making.

Don’t forget also share this post with your friends or relatives who are in urgent need of money and want to take a loan.

Frequently Asked Questions (FAQs)

Q. 1. Is the Money View Real or Fake?

This is a 100% real Loan Platform and really provides a loan, so you can take a personal loan up to a maximum of Rs. 5 lakhs.

Q. 2. Is the Money View loan safe or not?

This app is completely safe and authorized by RBI as well as regulated by NBFCs Financial Banks.

Q. 3. How much loan can I take from Money View?

You can take a minimum loan of Rs.10,000 to 5 lakh from Money View, it gives loan only to the salaried and self-employed individuals.

Q. 4. Does Moneyview also offer loans to non-salaried individuals?

Yes, Moneyview also gives loan to non-salaried individuals but for this you need to have a definite source of monthly income and minimum monthly income should be Rs.25,000.

Q. 5. Do I need to submit any collateral to avail loan from Moneyview?

To take a loan from Moneyview, you do not have to give any kind of collateral security, you can apply for the loan without any collateral.

Q. 6. Do I have to pay any processing fee for availing the loan?

Yes, for availing loan from moneyview you have to pay only one time processing fee of 2.5% to 8% depending on your principal loan amount.

Q. 7. How to Apply for Online Loan with Moneyview.

If you want to apply online for taking loan from Money View App, then you can follow the steps given below and apply for loan with just a few simple steps:

Step 1. First of all download and open the Money View loan app from the Play Store.

Step 2. Now provide your basic details and check your loan eligibility in 2 minutes.

Step 3. Next, choose your loan amount as per your requirement or the loan amount you are eligible for and the repayment tenure.

Step 4. Now complete the entire process by entering your KYC details and verify your income.

Step 5. Now wait for a few hours for the approval, if all the KYC details and documents are correct, the approval is easily obtained and after that the money is directly transferred to your bank account.

Q. 8. What is the minimum income required to avail Instant Personal Loan from Moneyview?

Money View offers instant personal loans to both the salaried and the self-employed. For this, the salaried individual should have a monthly income of Rs 20,000 and a CIBIL score above 675 and the self-employed should have a monthly income of up to Rs 25,000 and a credit score of 300 to 675 should be between.

Q. 9. How can we repay the loan?

You can pay the loan as monthly EMI.

Q. 10. How will my credit score be affected by this loan?

If you are not able to repay the loan on time or do not make it then your CIBIL score will be affected and if you make the payment on time then it will increase your CIBIL score.

Read More