Early Salary App is aware of the financial difficulties that today’s salaried professionals confront. Coping with cash shortages, especially towards the end of the month, is something you’d prefer to ignore. With Early Salary’s salary loan application, obtaining advances on your salary has never been easier, thanks to low interest rates as well as flexible repayment options through EMIs. Salary advances of up to ₹ 5 lakh are now available at interest rates as low as ₹ 9 per day and little paperwork. Now is the time to install the application and take advantage of the Early Salary benefit.

What is a Early Salary App?

The most creative Personal Loan App for Salaried Professionals is Early Salary. Salaried professionals earning more than ₹ 80,000 now can apply for a quick personal loan range from ₹ 3,000 to ₹ 55,000 on the application, that will be transferred to your bank account in 10 minutes just for ₹ 6 each day*.

Early Salary App Additional Details

| App Name | Personal Loan & Salary Advance App – EarlySalary |

| Size | 11MB |

| Version | 2.8.4 |

| Downloads | 50 Lakh+ |

| Rating | 4.5 stars |

| Released on | 22-Feb-2016 |

| Launched By | Social Worth Technologies Pvt. Ltd. |

| Download Early Salary | Early Salary App Download |

Early Salary App Review [Hindi Video]

How Early Salary App Works?

Early Salary lets users borrow up to ₹ 2,00,000 but only charges interest depending on how long you keep your money. The method is far less complicated than that of other banks, with fast approval or money transfer within hours (and sometimes minutes).

Services offered by Early Salary App

- Flexible Loan Amount.

Starting from ₹ 5,000 and going up to ₹ 5,00,000. It’s ideal for all of your cash demands.

- Fully Digital Journey.

There will be no lengthy forms. There will be no paperwork. Simply fill up a few details to receive quick cash.

- Available 24X7.

Repeat loans could be requested at any time and would be deposited into your bank account.

- Quick and Secure.

Getting instant cash is simple, quick, plus secure with the PCI DSS App-based experience.

What Types of Loan Services Does Early Salary App offers?

Shopping loan:

If it’s for a new outfit, phone, electronics, furniture, or home appliance, you may acquire immediate funds to shop for your favourite goods online with just an EarlySalary Shopping Loan.

- At EarlySalary, you may get Flipkart and Amazon shopping vouchers worth up to 100% of your salary as well as pay them back later for free or at a low cost EMI.

- You could repay the loan in three or six EMIs.

- You can however take out up to five shopping loans at once.

Loan for travel:

If you ever need a break in your routine but are unable to arrange a vacation due to a lack of cash, you may apply for a travel loan at EarlySalary.

- MakeMyTrip may help you plan your holiday while also allowing you to pay back the money you received through no-cost or low-cost EMIs.

- Take out a loan for 100% of your wage, which you can repay over three or six EMIs.

- Get up to 5 travel loans at once.

Loan to Improve Your Skills:

The FeEs Program at EarlySalary is meant to help you pay a skills improvement course or your child’s education by providing a loan of up to Rs. 5 lakh.

- EarlySalary sends the funds immediately to the organisation you want to pay.

- EarlySalary’s loan could be repaid in 3 to 12 EMIs, and there are no prepayment penalties if you pay off the loan even before the term is out.

- You could also take out up to two education loans from EarlySalary at a time and use them to pay the education of up to two children. For metro areas, the minimum qualifying wage is Rs. 30,000 per month, and then for non-metro cities, it is Rs. 25,000 per month.

Early Salary App Promo Code : appkhazana

Get ₹ 200 instant in your bank account by entering Early Salary Promo Code: appkhazana

How to download the Early Salary App?

- Open Goolge Playstore App.

- Search for Early Salary by typing “EarlySalary” in Seach Box.

- Install the Early Salary app on your device.

or

Download Early Salary App: Click Here [No Referral code needed]

Enter Referral Code: appkhazana

How to create an account on Early Salary App?

Just easily following the steps beneath, you can register for an Early Salary Personal Loan account online using the Early Salary mobile app or website:

Using the Early Salary App on a Mobile Device:

Step 1. Download Early Salary App from Google Playstore.

Step 2. After that, open the application and allow access to all permission.

Step 3. Now, enter your mobile number and you will get an OTP.

Step 4. Enter that OTP and sign in with your Google or LinkedIn account.

Step 5. Choose an account to continue to Early Salary.

Now you can easily apply for a loan.

By visiting the Early Salary’s website:

- Click on ‘Login’ on the Early Salary website.

- Select ‘Sign Up’ from the drop-down menu.

- To register but also apply for an Early Salary personal loan, provide the personal information, upload your bank statement, as well as other KYC papers.

Early Salary App Features

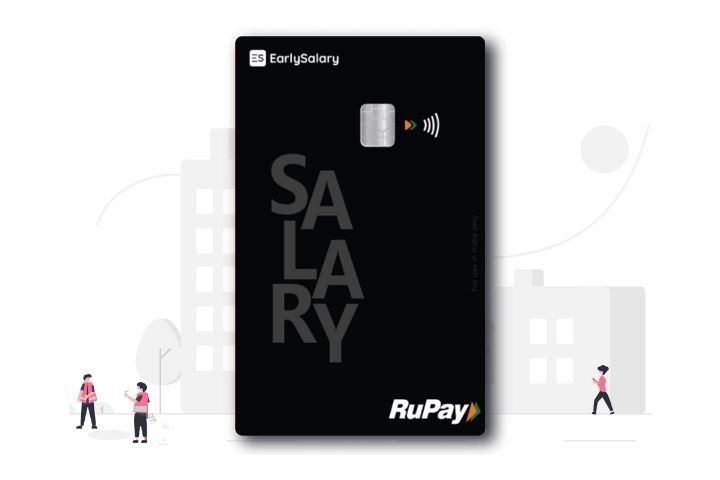

- A prepaid card having a balance of zero.

- It’s powered by RuPay that can be used in any retailer that accepts RuPay cards in India.

- Both digital and physical versions are available, and both have the same card details.

- The physical card is a pre-activated EMV chip-based card.

- A digital copy of the card tends to be made after the account is established.

- In-store transactions require the physical SalaryCard. Users must submit a request for this.

- The card must be used in the domestic transactions.

- From the time of purchase, your card works for 36 months.

- Transactions involving ATMs, casinos, or gambling are still not permitted.

- Credit that has been used must be repaid in EMIs. Any shopping category has different tenures.

- Shopping, travel and leisure, education, electronics, medical and insurance transactions are all possible with the SalaryCard.

Benefits of Early Salary App

We’ve given you plenty of reasons to choose Salary Advance with Early Salary.

- Instant loans of up to 5 lakh rupees are available.

- Money will be transferred to your bank account in minutes.

- The durations of repayment range from 90 to 730 days.

- There are no prepayment penalties, and you just pay interest on the amount you use.

- Advance salary loans at a rate of 24 percent to 30 percent per annum, or 2 percent to 2.5 percent per month.

Early Salary Eligibility Criteria to get a loan?

If you fulfil loan qualifying conditions, you can get a personal loan up to ₹ 5,00,000 from the comfort of your smartphone with Early Salary’s loan app. Traditional banks and lenders scrutinise your credit history as well as a number of other factors in order to determine your creditworthiness. You only need to meet four primary eligibility criteria to be eligible for Early Salary. Make sure you qualify for this, and you should have no trouble securing a personal loan.

Age:

At the time of your personal loan application, you should be at least 21 years old. You must be under 55 years old.

Income:

You must be a salaried employee with a monthly income of:

- If you live in metro cities like Delhi, Mumbai, Hyderabad, Kolkata, Bangalore, or Chennai, ₹ 18,000 should be your monthly salary.

- Your monthly salary should be ₹ 15,000 to get started if you live outside of a metro area.

Citizenship: You should be an Indian citizen.

KYC: You must have all of the relevant KYC documents.

Documents required to Get a Loan From Early Salary App

Documents required to Get a Loan From Early Salary App are listed below:

- PAN Card

- Passport/Aadhaar card/Driving License

- Cancelled cheque leaf of your salaried bank account.

- Last 3 Month Salary Slip (PDF) – This document is not required for all customers.

How to repayment my loan amount in Early Salary App?

- Bi-weekly payments are the way to go.

- With each raise in your wage, you can quicken the repayment process.

- Once you have a lot of loans in your basket, refinance is the way to go.

- Credit card balances can be converted to EMIs.

- You could round up your payments if necessary.

How to get EarlySalary’s SalaryCard?

Step 1. Open the EarlySalalry App

Step 2. Select the SalaryCard tab.

Step 3. Complete the required information by tapping on Images.

Step 4. Fill and complete your Personal Profile, Professional Profile and Current Residential Address.

Step 5. Add your salaried bank account and bank statement for the last 3 months.

Step 6. Respond to a few simple questions.

Step 7. Complete the KYC process by agreeing to the OTP.

Step 8. To activate the card, create a passcode.

Early Salary Customer Care

Customers can contact Early Salary customer service at 020-67639797 for immediate loan-related questions (charges may apply).

Customer Service Email Address for Early Salary

Customers could send an email to customer service representatives to have their questions answered. A person will often respond to your email within 24-48 hours. Early Salary’s customer service email address is [email protected].

| Phone Number | 020-67639797 |

| [email protected] |

Customer Service on Social Media for EarlySalary

Customers of Early Salary can contact a customer service representative or learn about special offers by following the company on social media channels including Facebook, Twitter, and LinkedIn. Keep in mind, though, that you should always adhere to data security best practices and never post personal client information on social media networks.

Conclusion

It’s time to make amends for the first half of the year and enjoy life to the fullest. Don’t let a cash crunch at the end of the month or high electrical costs derail your plans to attain your objectives. Customers can get quick cash transfers by downloading an app and filling out a simple form. Rest confident that the customer will have a pleasant experience.

FAQs Related To Early Salary App

Is EarlySalary App safe?

EarlySalary not just to disburse your loans swiftly, but they also maintain your information safe. Hundreds of thousands of pleased consumers have received millions of dollars as a result of the company’s commitment to client satisfaction and data protection.

Who owns EarlySalary?

‘EarlySalary,’ founded by Ashish Goyal and Akshay Mehrotra, provides unsecured, conveniently accessible financial help.

Is EarlySalary registered with RBI?

Yes! As EarlySalary Services Private Limited (“ESPL”) is a Non-Banking Financial Company that is registered with the Reserve Bank of India (“RBI”). sections of the community.

What is the rate of interest on EarlySalary Loan repayment?

Interest is payable on Early Salary loans at a rate of 2% per month. This seems to be practically a rate of 24 percent every year, and this is based on the amount borrowed.

What is EarlySalary’s SalaryCard?

SalaryCard, the new sort of credit line created solely for salaried personnel, was launched by EarlySalary in collaboration with DCB Bank. The card can be applied for using the EarlySalary smartphone app by those that are eligible.

Also Read: